Fellow Stockholders

Our Company experienced its second consecutive year in the last six of lower profitability as measured by funds from operations or FFO1. For full year 2016, our FFO totaled approximately $106.3 million or $1.03 per share. The results on a per-share basis reflect an 8% decrease in FFO over the past two years. Dividend distributions paid for full year 2016 totaled $0.76 per share, unchanged from 2015. These results were anticipated and the decline in FFO occurred primarily as a result of the near-term effects of our ongoing initiative to transform FSP's property portfolio from smaller, suburban office assets located in many diverse markets across the U.S., to larger urban-infill and CBD office assets located primarily within our five core markets of Atlanta, Dallas, Denver, Houston and Minneapolis. As 2017 begins, I am pleased to announce that the bulk of this transformation is substantially complete and we believe that our Company's current office property portfolio now has increased potential to produce higher and more sustainable rental growth over the coming years than ever before. We anticipate FFO growth to resume in 2017 and for the portfolio to provide better opportunities for long-term value appreciation.

During 2016, the U.S. economy continued its trend of moderate growth and lower unemployment rates. In general, we believe that the U.S. office market is experiencing positive performance in rental rate and occupancy statistics. The directly-owned FSP portfolio of 36 properties comprised of approximately 10.2 million square feet concluded 2016 at 89.3% leased. At this early stage of 2017, we believe the most likely outlook for the economy is a continuation of moderate growth, as changing economic and tax proposals from the newly elected administration may take time to have an impact or struggle to find support in Congress. As a result, we believe that the actual impact of the recent presidential election on the U.S. economy is too early to predict. We will continue to monitor interest rates, as well as the broader capital markets, to balance opportunity and risk for our future growth plans.

During 2017, we believe that three primary drivers will positively impact our results. The first driver is leasing existing vacancy within our broader property portfolio and, more specifically, within our five core markets. Our leasing teams are currently seeing meaningful leasing interest from prospective tenants at our higher rent properties that have the potential to significantly impact FFO growth. The second driver is the impact of full-year rent contributions from our 2016 acquisitions in downtown Minneapolis, Midtown Atlanta, and downtown Denver. The third driver is the impact of our redevelopment of 801 Marquette in downtown Minneapolis as construction efforts are completed and prospective new tenant leases are ultimately signed and commence. Additionally, FSP will continue working on its portfolio transformation efforts by selectively selling remaining non-core suburban properties when values have been maximized and pricing results are acceptable. We will also continue to carefully monitor our five core markets for new urban-infill and CBD property investment opportunities.

Thank you for continued trust, confidence and support.

George J. Carter

Chairman and Chief Executive Officer

1 FFO is a non-GAAP financial measure currently used in the real estate industry that we believe provides useful information to investors. Please refer to page A-1 of this Annual Report for a definition of FFO and a reconciliation of net income to FFO.

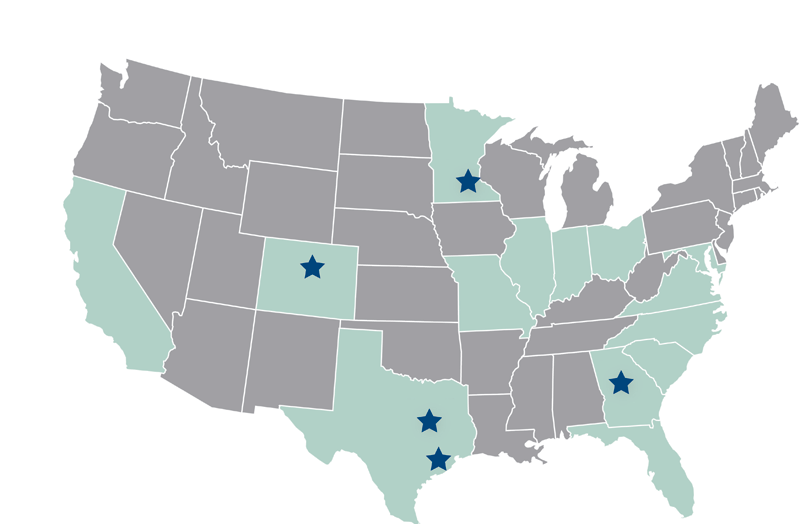

- Franklin Street Properties owns and/or manages approximately 12.6 million square feet of office space located in 14 different states (as of December 31, 2016).

- Approximately 75% (in square feet) of FSP's owned portfolio is located within our five core markets..